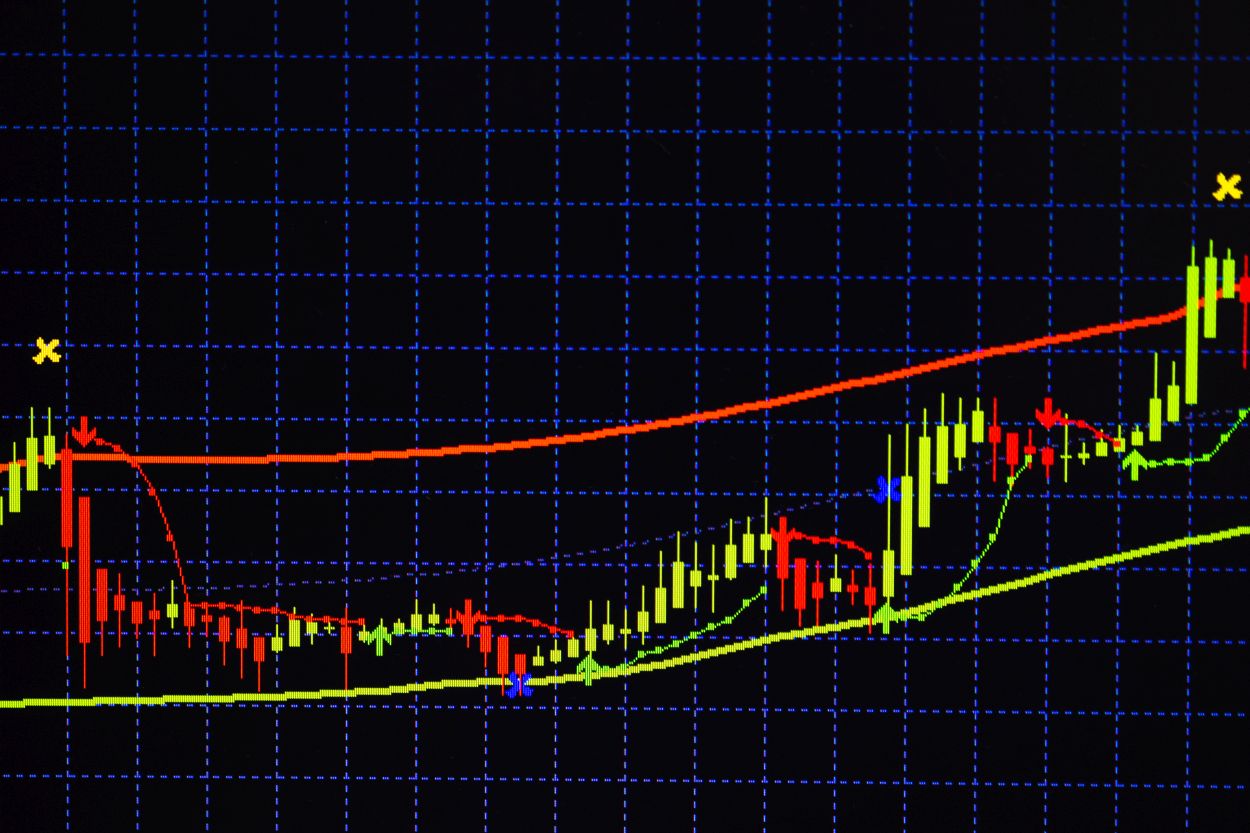

- The bearish stability still dominates the performance of the EUR/USD currency pair since the start of trading this week.

- According to its performance, it fell to the 1.0122 support level before settling around the 1.0180 level at the time of writing the analysis.

- Performance supported by investors’ appetite to buy the US dollar as a safe haven, in addition to strong expectations for the future tightening of the US Federal Reserve’s policy.

EUR/USD Forecast for Coming Days

The rise of the US dollar will continue and ensure that the euro remains under pressure, according to new research from Swedbank. The Scandinavian bank and investment bank say it is maintaining its EUR/USD exchange rate forecast to stay on course to test the parity rate 1.0 support. Anders Eklöf, chief forex analyst at Swedbank, says, “The notion that the peak of headline inflation in the US would be enough to calm the Fed is wishful thinking. US dollar longs were lowered, and pricing showed less than 50/50 gain of 75 basis points in September. We see continued demand for the US dollar when buying and the challenge, and therefore the future outlook in Europe / China, and the EURUSD is back to parity.”

These forecasts come after a period of respite for the euro that saw its advance against the dollar during most of July and the first half of August. The rise reached its peak on the background of data from the United States of America, which showed that inflation rates have reached their highest levels, and with it the US Federal Reserve interest rate hike cycle.