The dollar was weaker initially at the start of last week but found a footing with a bit more of a push and pull feel as markets are able to now fully switch their focus on the Fed this week. Despite being pulled back a little, the dollar sits in a good spot – from a technical perspective – as we head towards the FOMC meeting on Wednesday.

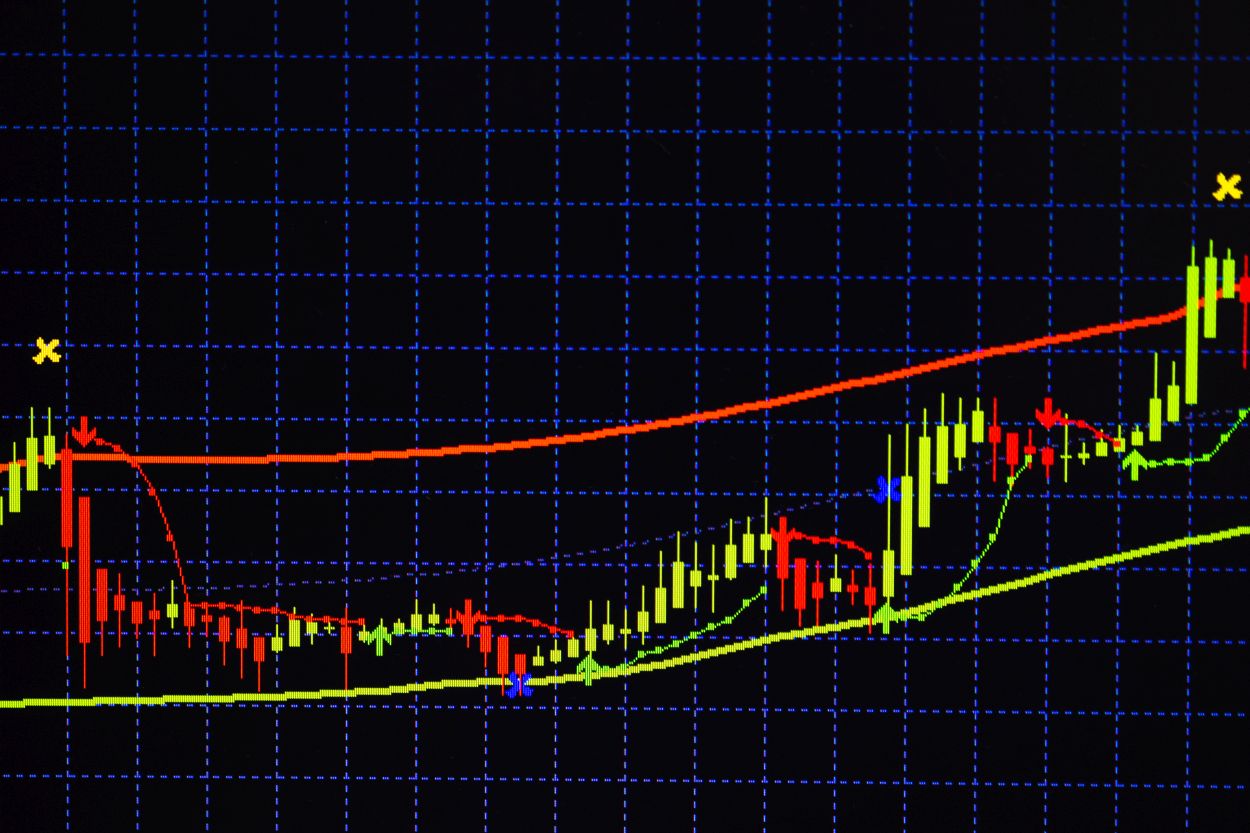

EUR/USD is keeping in and around the 1.0200 level as the euro fails to really find much impetus in the recent rebound to push towards testing the 50.0 Fib retracement level at 1.0283:

The euro side of the equation is rather unattractive, even if the ECB sort of surprised with a 50 bps rate hike last week. The fundamentals of the economy are rather dire and if a bigger-than-expected rate hike wasn’t enough for a breakout push, I don’t think the euro has much else to offer.

Meanwhile, USD/JPY remains caught between the range of 135.00 to 140.00. However, the bond market is in charge and all eyes are on the Fed. There was a strong bid in bonds towards the latter stages of last week after the ECB and that might be something to watch out for this week in case it carries over. USD/JPY is now trading around 136.30 with little sense of any directional breakout unless we get closer to either side of the range above.

As for GBP/USD, the pair is pinned back down below 1.2000 again and buyers have really struggled to hold a firm break above the key level since last week:

The 200-hour moving average (blue line) is providing near-term support so the key technical levels are very well outlined at the moment for both buyers and sellers. There needs to be a break on either side of that to really convince of a further extension in the action.

Looking at commodity currencies, USD/CAD is little changed on the day and sticking closer to 1.2920 after a push lower last Friday failed to really breach the 28 June low at 1.2820. The pair rebounded to close above 1.2900 and is holding for now, with buyers needing to clear 1.3000 again to convince of a push back to the upside.

AUD/USD is also little changed on the day, sticking closer to 0.6900 still since the end of last week. The high hit 0.6977 but failed to really contest the 50.0 Fib retracement level at 0.6982:

That and the 0.7000 handle should keep things in check ahead of the Fed as risk tones are also looking fairly more pensive to kick start the new week.