It’s not until we clear the 1.06 level that I would consider buying the Euro.

The Euro bounced ever so slightly during the trading session on Wednesday as the FOMC Meeting Minutes came out. There are a few comments in that release that could suggest a bit of hesitation, but we are still playing the same game of trying to determine what people on the FOMC are going to do when they don’t seem to have any idea themselves.

This sets up for more noise and chop, which has been the case for most of the year. The EUR/USD pair is like a slow-moving train wreck, as the European Union seems to be a bug looking for a windshield at this point. Nonetheless, we still must deal with the market we are dealt. I think at this point it’s likely to remain somewhat sideways as we try to figure out what we’re going to do.

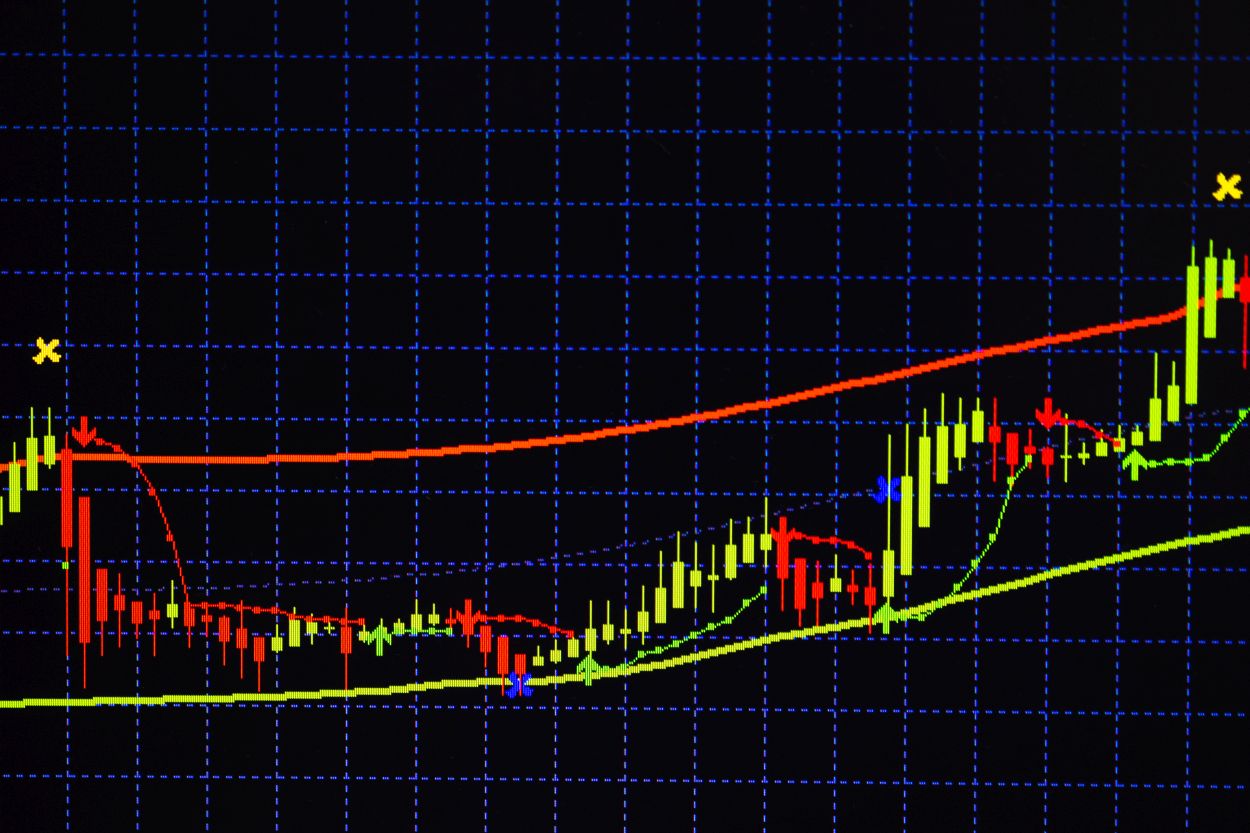

We have the 50 Day EMA sitting right around the 1.03 level. One would have to think that is a relatively good sign for resistance, and even if we were to break above there, it’s likely that we will see plenty of resistance at the 1.04 level as well. In other words, this is a market that I think given enough time will probably have to bust through a lot of selling pressure to go anywhere. However, in the short term it looks like we are due for a little bit of a bounce, perhaps back to the top of the overall range.