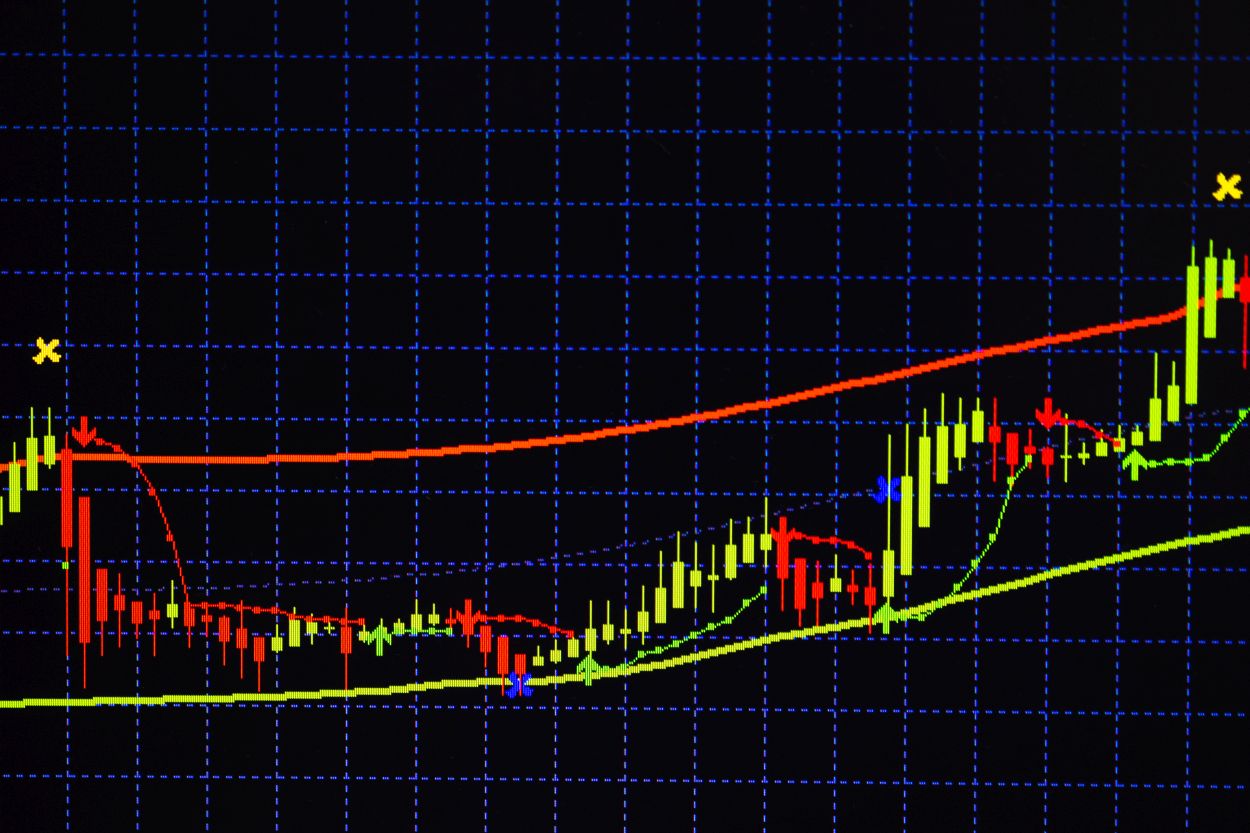

Fading rallies will continue to be the path forward, with an eye on getting down to the 3500 level eventually.

The S&P 500 has seen a lot of volatility for the month of September, and October is likely to be more of the same. At this point, the markets are finally starting to believe that the Federal Reserve is going to follow through with extreme tightening. This is a stark contrast to what we have seen for 14 years, as the Fed seemingly made it their sole purpose to prop up Wall Street.

Perhaps it is because the Fed governors aren’t allowed to day trade anymore that the central bank finally found religion? Now that they are focusing on the economy, they must unwind almost 15 years of ultra-loose monetary policy, without wrecking everything. Remember, we are essentially in a “bubble of everything”, of whose blame you can lay squarely at the feet of the Fed. The institution has lost all credibility at this point, so it will do everything it can to earn it back.

The Fed members have stated that they are going to tighten until inflation reaches its target of 2%, even if there is “some pain.” It is going to tighten credit, precisely at a time when more dollars are needed around the world to pay off debt. (Dollars aren’t a function of “Fed go burr”, they are created by new loans.) In this scenario, the US dollar will continue to strengthen, which is toxic to stocks in the US. This is mainly because US goods become very expensive in other parts of the world. Exports are going to be pummeled going forward. Analysts are just now writing down estimates.

The S&P 500 has pierced the 200-Week EMA, which is an ominous sign as well. This means that algo traders are now joining the fray – at least the ones that haven’t already puked up their long positions. However, I am still hearing about how “valuations are cheap” on a lot of stock. While I do think that we will see some kind of bounce in the market during October, this is the kind of thinking that will get people crushed in this market.