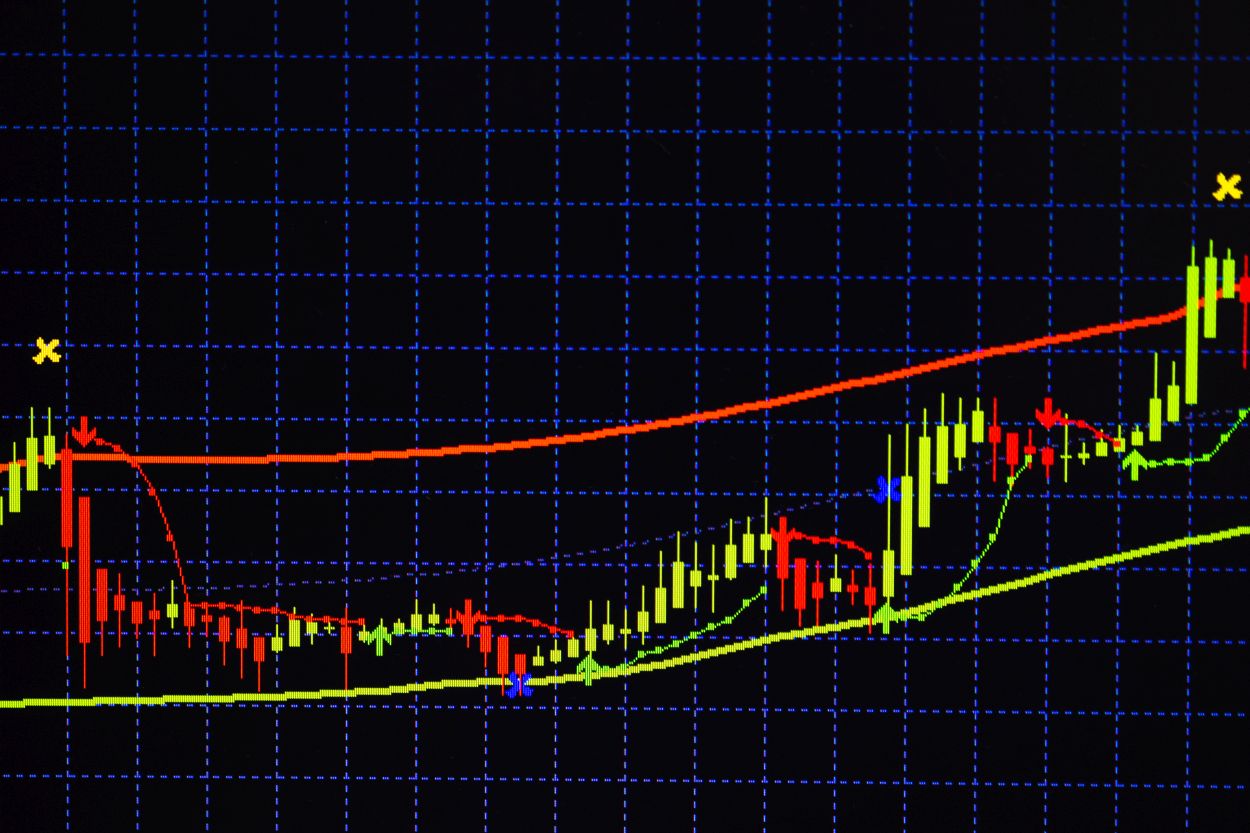

We are back where we started. The US market completely destroyed the gears after a strong non-farm payrolls report. The SandP 500 is now down just 5 points to ,071, closing the week above its 200-day moving average for the first time since April. This is an impressive feat. More interesting is the ceaseless supply of long-term bonds. US 10 shares fall 3 basis points to 3. 9% from a high of 3.63%. US 30s are down 8 basis points to 3.55% from a high of 3.70%. US 30s One school of thought is that bond market participants are trying to get ahead of the „next big deal,” which is a weakening global economy and declining inflation. Whatever it is, returns will fall on the US dollar.

The bid for stocks and bonds is relentless