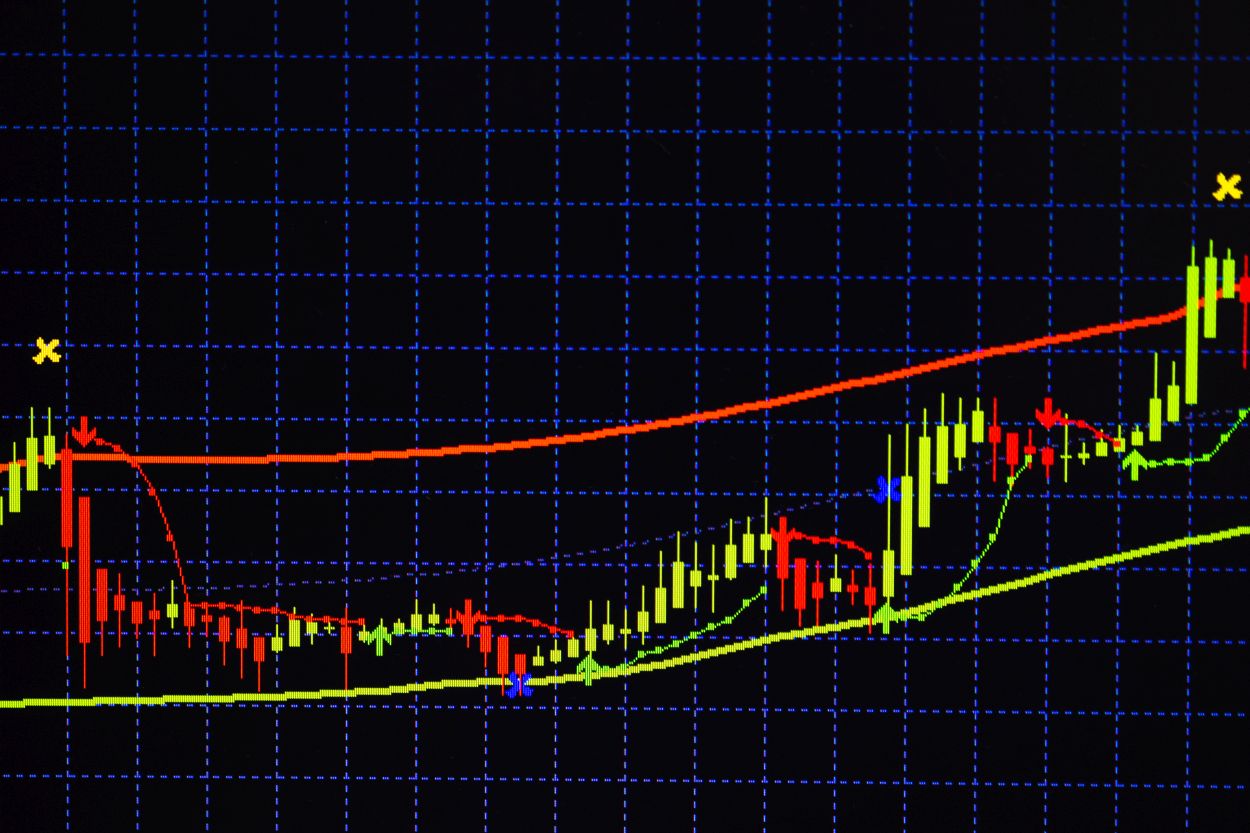

The index is trading in a tight range near 106.80. USA reverses and now slides back into the red zone. CB leading index, residential data is the next note of the NA session. Greenback is trading with gains and losses on the USD Index (DXY) measured in the 106.70 area, with a general lack of direction in global markets on Friday. USD INDEX NOW FOCUSING ON DATA Despite the current volatile price action, the index is still on track to end the week with a small gain after the last sharp pullback seen. in response to St. Louis Fed J. Bullard’s hawkish comments on Thursday, which prompted a possible discussion of a reversal in Federal Reserve policy at a December event. In the American calendar, the main index of CB follows after existing home sales and the call of S.Collins of the Boston Fed. What to Look For The dollar’s move around the US dollar remains volatile, with the index declining to continue to hover near 106.50, all amid a broad consolidation theme. At the same time, the dollar is expected to remain under control, as investors will likely continue to watch the Fed’s rate cut more slowly in the coming months. US Key Events This Week: CB Lead Index, Existing Home Sales (Friday). Important issues in the background: US midterm elections. Hard/soft/soft? The decline of the US economy. Prospects for a sustained central bank interest rate hike against recession speculation in the coming months. switch Geopolitical confusion against Russia and China. The ongoing trade conflict between the United States and China. USD Related Index Levels Now the index is up 0.11% to 106.81 and should reach the next high limit of 109.15 (100 day SMA) followed by 110.76 (55 day SMA) and then 113.1 (month high on 3 November). ). On the other hand, a break of 105.3 (monthly low of November 15) would open the door to 105.05 (200-day SMA) and eventually 10 .63 (monthly low of August 10).

USD INDEX WOBBLES AROUND 106.80, LOOKS AT DATA, FEDSPEAK