- USD/JPY drops to a one-and-half-month low and is pressured by a combination of factors.

- The USD languishes near a multi-week low amid bets for a gradual Fed tightening path.

- The narrowing US-Japan rate differential, a softer risk tone benefits the safe-haven JPY.

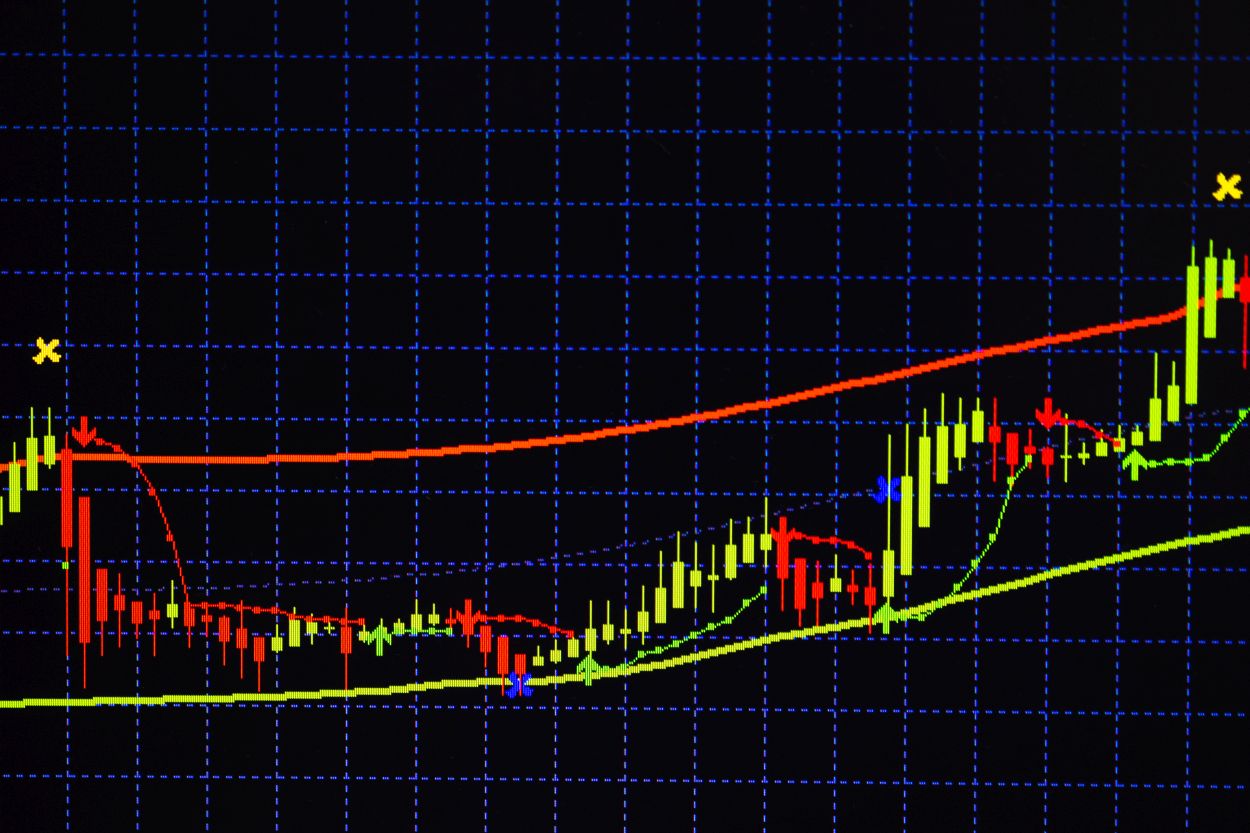

The USD/JPY pair finds some support and recovers a few pips from the 132.00 neighbourhood, or a one-and-half-month low touched earlier this Monday. The pair remains depressed for the fourth successive day and is seen trading just below the mid-132.00s during the early European session.

The US dollar languished near its lowest level since July 5 and turns out to be a key factor exerting some downward pressure on the USD/JPY pair. Friday’s stronger US Personal Consumption Expenditures (PCE) price index data was overshadowed by fears about an economic downturn. This continues to fuel speculations that the Fed would not raise rates as aggressively as previously estimated and is acting as a headwind for the greenback.

On the other hand, a combination of factors is seen to boost demand for the Japanese yen and also contribute to the USD/JPY pair’s downfall. The prospects for a less aggressive policy tightening by the Fed have led to the recent decline in the US Treasury bond yields, resulting in the narrowing of the US-Japan rate differential. This, along with a softer risk tone, has been driving flows towards the traditional safe-haven JPY.

That said, a big divergence in the monetary policy stance adopted by the Bank of Japan (dovish) and other major central banks should keep a lid on any meaningful gains for the JPY. This, in turn, could lend some support to the USD/JPY pair. Investors might also refrain from placing aggressive bets and prefer to wait on the sidelines ahead of this week’s important US macro releases, scheduled at the beginning of a new month.