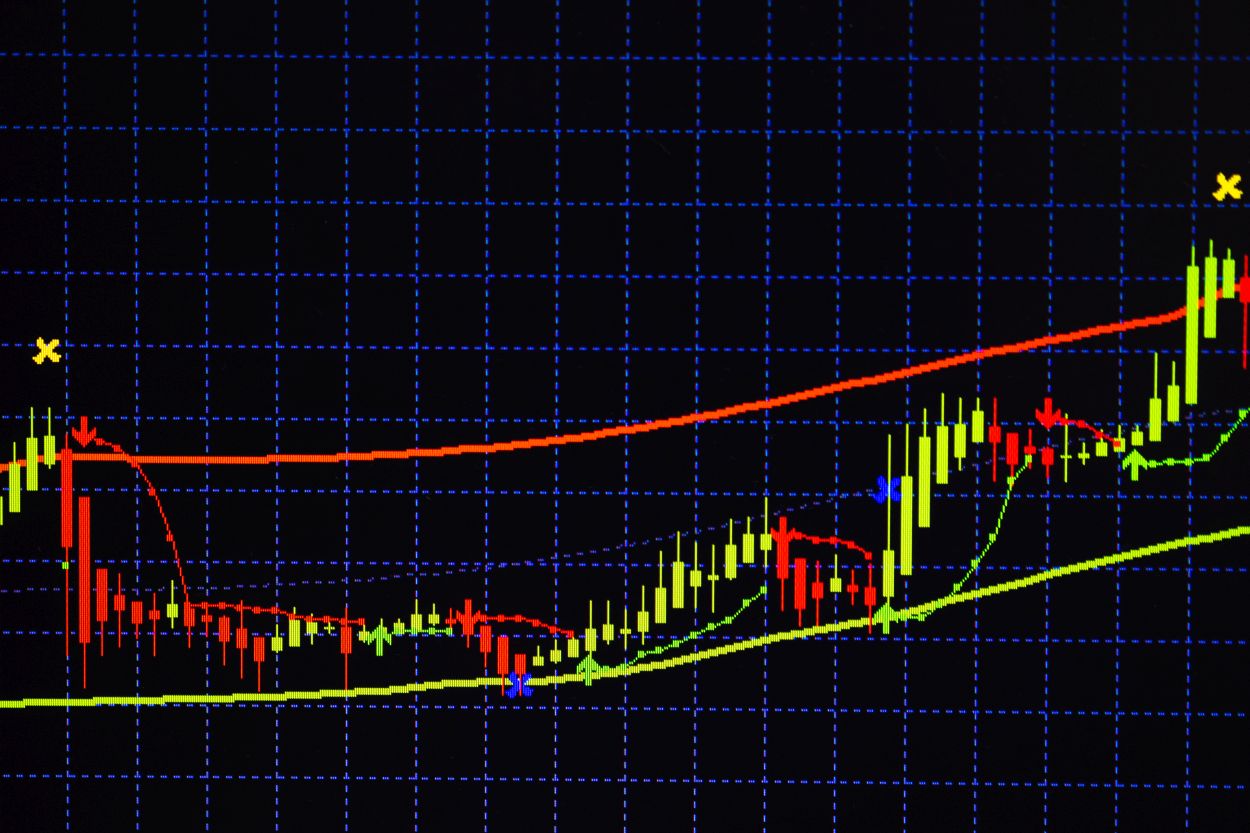

WTI oil is down 8% this week to test a low of $85.50. Crude Oil Prices Affected by Recession Fears. WTI price forecast rose to $9 – TDS in the fourth quarter. , WTI futures returned lower on Friday and fell 8% for the week after hitting a high of $93.58 on Monday. The US oil benchmark extended gains from Thursday’s rally to test support at $85.50. OIL PRICE FALLS ACROSS NATIONAL FEARS Crude oil prices have moved sharply this week as markets grow increasingly concerned about the potential impact of the global recession on demand, along with aggressive monetary tightening by most major central banks. In the United States, the Consumer Index report, published earlier this week, confirmed the resilience of inflationary pressures, giving the Federal Reserve more reasons to approve another aggressive tax rate in November. In fact, there was a 13 percent chance that federal funds futures would settle by 100 basis points immediately after the release of US inflation data. These tight expectations make the US dollar more attractive to investors and continue to weigh on oil prices. This week’s events offset the positive impact on oil prices from the OPEC production cuts announced last week. The club of the world’s largest oil suppliers agreed to cut production by 2 million barrels per day, the biggest cut since the outbreak of the COVID-19 pandemic. WTI PRICE TARGET UPDATED TO $9 Q – TDS In a broader perspective, TD Securities strategists remain optimistic about the possibility that OPEC cuts will lead to higher prices: „We are pleased to note that the latest production targets by OPEC members became very. expensive persuasively high price risks. That is why we upgraded our IV-22. quarter WTI forecast to $ 9 Brent ($ 99 Brent) and the 2023 average of $ 97 Brent ($ 101 Brent).

WTI, ON RETREAT, TESTING 10-DAY LOWS AT $85.50 AREA